south dakota motor vehicle sales tax rate

The date that you. Mobile Manufactured homes are subject to the 4 initial registration fee.

File And Pay Your Sturgis Rally Sales Tax Online South Dakota Department Of Revenue

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

. 115 Louisiana 1145 and Arkansas 1125. South Dakotas 8000-mile networks of highways and airport runways are essential to the states economy and its citizens quality of life Fuel taxes are used to fund. 3 due on total.

300 maximum tax does not apply and the lease is subject to the sales and use tax at a rate of 6 plus the applicable local sales tax rate. The information you may need to enter into the tax and tag calculators may include. 65 local 03 motor vehicle sales lease tax total Look-up Tool Select current rate sheet find location add 03 003 to the combined tax rate listed.

Motor Fuel Excise Taxes. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states.

However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. For vehicles that are being rented or leased see see taxation of leases and rentals. South dakota motor vehicle sales tax rate.

Click Search for Tax Rate. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax.

With local taxes the total sales tax rate is between 4500 and 7500. For cities that have multiple zip codes you. In addition to taxes car.

The state sales tax rate in South Dakota is 4500. The lease is subject to the tax even if the motor. Tax Basics South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to all sales or purchases of taxable products and services.

Motor Vehicle Sales or Purchases. South Dakota has a 45 statewide sales tax rate but also has 289 local tax. The south dakota state sales tax rate is 4 and the average sd sales tax after local surtaxes is 583.

The SD use tax only applies to certain purchases. 2 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases. Counties and cities can charge an additional local sales tax of up to 2 for a maximum.

The vehicle identification number VIN. State Sales Tax plus applicable municipal sales tax applies to the selling price of dyed fuel when it is. Can I import a vehicle into South.

North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. 2022 South Dakota state use tax. In South Dakota an ATV MUST be titled.

South Dakotas excise tax on gasoline is ranked 35 out of the 50. 45 Municipal Sales and Use Tax Applies to all. States with High Sales Tax.

All Vehicles including ATVs and Motorcycles. New Purchase not yet titled in the Applicants name. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. The make model and year of your vehicle. While south dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Ohio is the most recent state to repeal. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. States with high tax rates tend to be above 10 of the price of the vehicle.

The South Dakota use tax is a special excise tax assessed on property purchased for use in South. 4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable. Enter a street address and zip code or street address and city name into the provided spaces.

South Dakota Excise Tax. 4 due on total purchase price Watercraft. Depending on what the dyed fuel is being used for will determine the tax rate that is paid.

Purchasers in south dakota are charged a. South Dakota - 4. South Dakota has recent rate changes Thu Jul 01.

35th highest gas tax.

Apply For Your Sales Property Tax Refund South Dakota Department Of Revenue

Motor Fuel South Dakota Department Of Revenue

Motor Fuel South Dakota Department Of Revenue

Businesses South Dakota Department Of Revenue

Businesses South Dakota Department Of Revenue

Owner Occupied And Contractor Owner Occupied Application South Dakota Department Of Revenue

South Dakota Sales Tax Small Business Guide Truic

Business Faqs South Dakota Department Of Revenue

Filing And Paying Taxes Online Help South Dakota Department Of Revenue

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Federal Ruling Changes Odometer Requirements South Dakota Department Of Revenue

See The New State Seal Specialty Emblem Here South Dakota Department Of Revenue

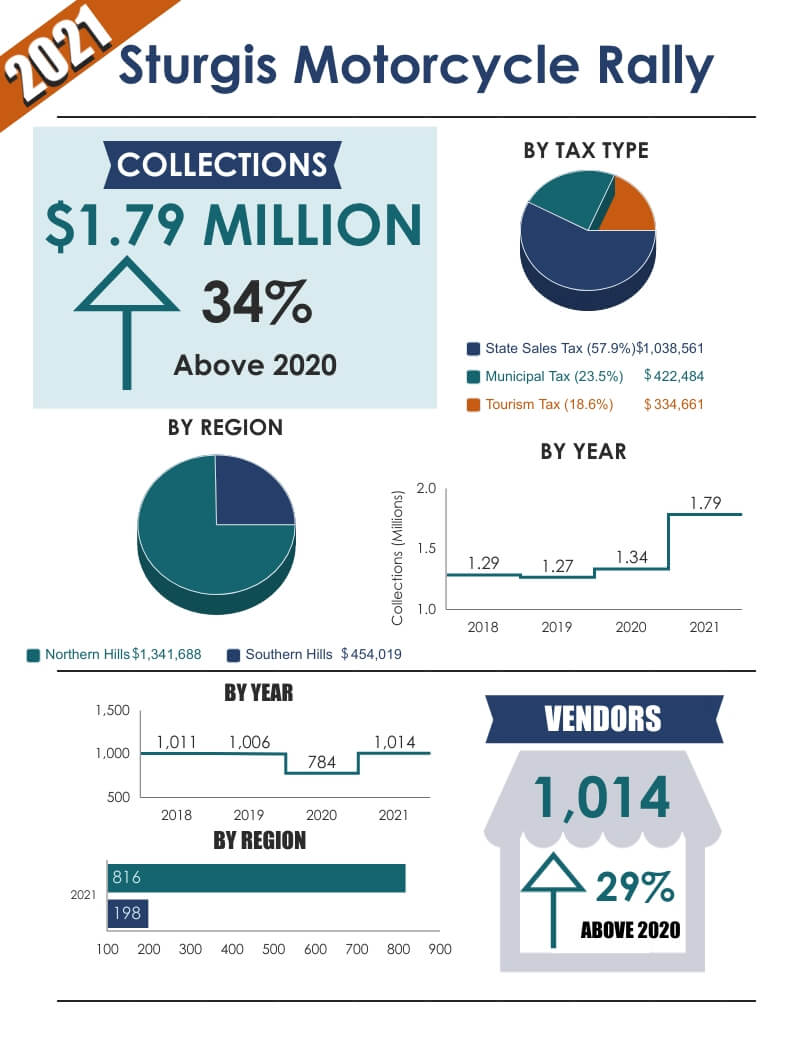

Tax Revenue Scales To 1 79 Million At 2021 Sturgis Motorcycle Rally South Dakota Department Of Revenue

New Municipal Tax Changes Effective July 1 2021 South Dakota Department Of Revenue